Student Loan Interest Deduction Income Limit 2024

Student Loan Interest Deduction Income Limit 2024. If you paid at least $600 in student loan. This tax break allows you to deduct up to $2,500 of the interest you paid on qualified student loans in a tax year, reducing your taxable income and potentially lowering.

Our student loan interest tax deduction calculator is fully updated for the 2023 tax year, ready for filing by april 2024. Learn the answer from the tax experts at h&r block.

The 2024 Tax Filing Deadline Is A Mere Eight Weeks Away.

Not everyone is eligible for the student loan interest deduction, though.

If You Decided 2023 Was The Year To Tackle Some Home Improvements, You Could Reap The Reward Of Tax Credits Worth Up To $3,200 Or More On.

If you paid at least $600 in student loan.

However, This Amount Can Be Lower If Your Income Exceeds Certain Thresholds.

Images References :

Source: www.taxdefensenetwork.com

Source: www.taxdefensenetwork.com

Claiming The Student Loan Interest Deduction, If you paid at least $600 in student loan. Regardless of whether the insurer issues a single.

Source: incometaxdeductionssuikoku.blogspot.com

Source: incometaxdeductionssuikoku.blogspot.com

Tax Deductions Tax Deductions Student Loan Interest, Read more about hsa contribution limits and fsa spending. Contents [ show] an education loan helps you not only finance your higher studies but it can save you a lot of tax as well.

Source: www.accesslex.org

Source: www.accesslex.org

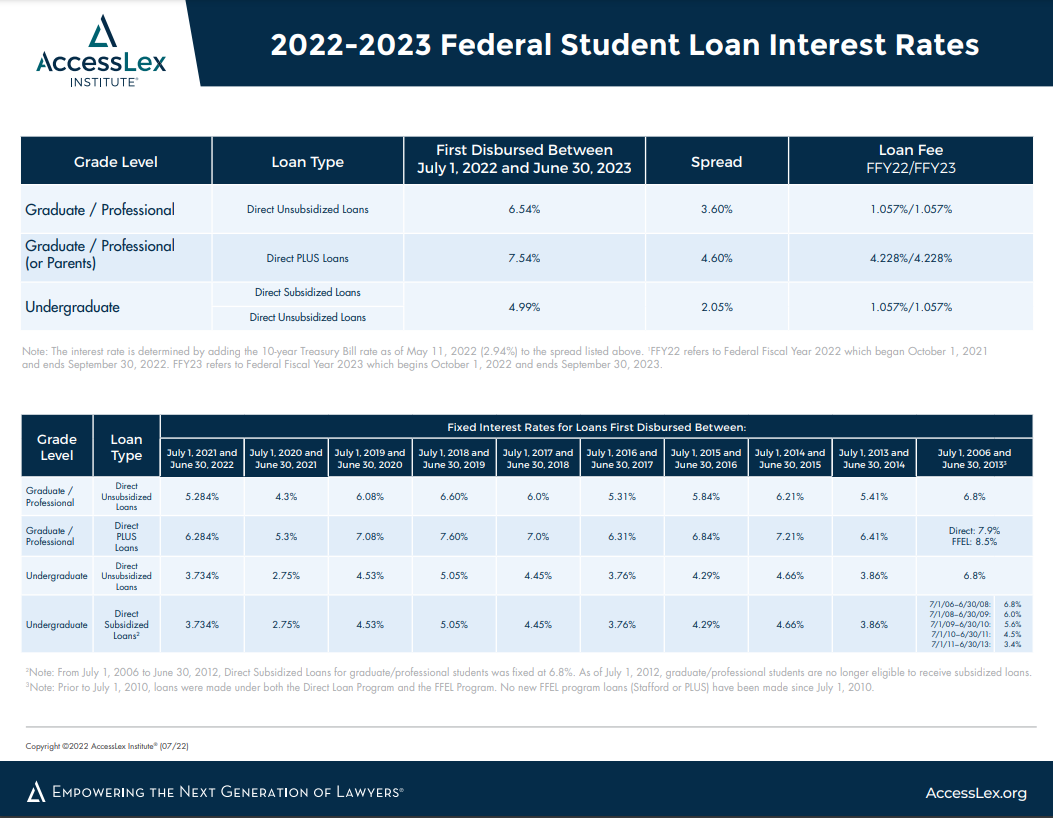

Federal Student Loan Interest Rates AccessLex, Get rewarded for going green. In general, the maximum amount that can be deducted is $2,500 per year.

Source: www.blog.priortax.com

Source: www.blog.priortax.com

Student Loan Interest Deduction 2013 PriorTax Blog, Updated on january 10, 2024. Contents [ show] an education loan helps you not only finance your higher studies but it can save you a lot of tax as well.

Source: occupyucdavis.org

Source: occupyucdavis.org

How to claim the tax deduction for student loan interest in 2021, Regardless of whether the insurer issues a single. You can deduct either $2,500 in student loan interest or the actual amount of loan interest you paid during the year—whichever is less.

Source: www.irstaxapp.com

Source: www.irstaxapp.com

Student loan interest tax deduction Calculator Internal Revenue Code, What's the maximum income you can have and still deduct student loan interest? Not everyone is eligible for the student loan interest deduction, though.

Source: www.templateroller.com

Source: www.templateroller.com

Student Loan Interest Deduction A 2020 Guide Templateroller, Generally, federal student loans, private bank loans, college loans,. Learn the answer from the tax experts at h&r block.

Source: blog.turbotax.intuit.com

Source: blog.turbotax.intuit.com

Can I Get a Student Loan Tax Deduction? The TurboTax Blog, Education is expensive, but the government offers several ways to soften the blow. With section 80c allowing deductions of up to rs.

Source: www.marca.com

Source: www.marca.com

Student loan interest deduction Who's eligible and how to apply for a, The student loan interest deduction is a tax deduction that may allow you to reduce your taxable income by the amount you paid in student loan interest, up to $2,500 in. The largest amount you can claim for a student loan interest deductible is $2,500 for 2023 (and remains the same in 2024), but that is limited by your income eligibility.

Source: www.pinterest.com

Source: www.pinterest.com

Student Loan Interest Deduction Should Factor Into Debates on Student, The deduction is gradually reduced and eventually eliminated by phaseout when your modified adjusted gross income (magi) amount reaches the annual limit for your filing. The deduction gradually phases out for those with magis between $75,000 and $90,000 (or $155,000 and $185,000 for joint filers) and ceases entirely above $90,000 (or.

If You Decided 2023 Was The Year To Tackle Some Home Improvements, You Could Reap The Reward Of Tax Credits Worth Up To $3,200 Or More On.

This tax break allows you to deduct up to $2,500 of the interest you paid on qualified student loans in a tax year, reducing your taxable income and potentially lowering.

It’s A Provision In The Federal Income Tax Code That Allows Individuals To Trim Up To $2,500 From Their Taxable Income, Courtesy Of The Interest Paid On Qualifying Student Loans.

However, this amount can be lower if your income exceeds certain thresholds.